The automotive industry is undergoing a profound transformation, driven by electrification, connectivity, and software‑defined features. Among these evolutions, the transition from traditional metal keys to digital car keys stands out for its immediate impact on convenience, security, and user experience. By leveraging smartphones, wearables, and emerging wireless protocols, automakers are redefining how drivers access and interact with their vehicles. No longer confined to physical fobs, vehicle entry can now be personalized, remotely managed, and even shared across a network of approved users. In this comprehensive article, we delve into the advancements in digital car key technology, exploring its evolution, underlying mechanisms, benefits, challenges, industry players, and future outlook.

Evolution of Vehicle Access

Automotive access systems have progressed through distinct phases:

A. Mechanical Metal Keys: The earliest automotive locks relied on cut‑steel keys and tumblers—simple, reliable, but easily duplicated and lacking remote control.

B. Remote Keyless Entry (RKE): Introduced in the 1990s, RKE fobs added basic radio‑frequency (RF) unlock and lock commands, improving convenience but remaining vulnerable to relay attacks.

C. Smart Key Fobs: Early 2000s models embedded RFID chips and rolling codes, enabling passive entry without button presses, but still requiring proximity and specialized hardware.

D. Smartphone Apps: Mid‑2010s saw the emergence of OEM apps offering remote lock/unlock, but these often required manual initiation and lacked seamless integration with onboard systems.

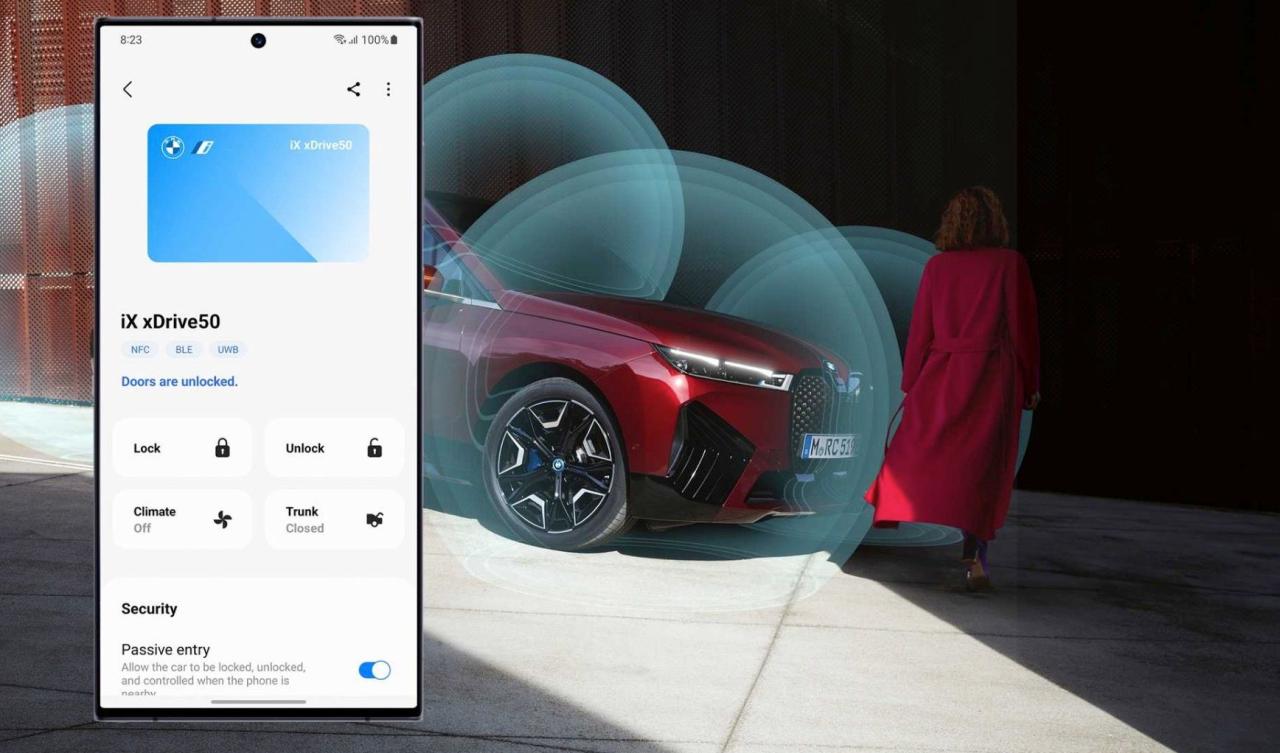

E. Digital Car Keys: Today’s digital keys integrate Bluetooth Low Energy (BLE), Near‑Field Communication (NFC), and Ultra‑Wideband (UWB) to deliver hands‑free, encrypted, and user‑managed access directly via personal devices.

Key Technologies Behind Digital Keys

Digital car keys rely on a blend of wireless protocols and secure elements:

A. Bluetooth Low Energy (BLE): Enables passive entry by detecting an authorized device within range (typically 1–10 meters) and unlocking doors automatically.

B. Near‑Field Communication (NFC): Requires close proximity (under 10 cm) for authentication—ideal for sharing access with temporary users via tap‑to‑unblock.

C. Ultra‑Wideband (UWB): Provides centimeter‑level ranging accuracy, preventing relay attacks by verifying true distance between device and vehicle.

D. Secure Enclave & Trusted Execution Environment (TEE): Protects cryptographic keys on smartphones and ECUs, ensuring credentials cannot be extracted even if the device is compromised.

E. Over‑The‑Air (OTA) Updates: Delivers security patches and feature enhancements to vehicle access modules without dealer visits, maintaining resilience against emerging threats.

Enhanced Security Measures

Moving beyond simple RF, digital car keys incorporate multiple safeguards:

A. Mutual Authentication: Both vehicle and device verify each other’s identities via encrypted challenge‑response protocols, preventing spoofing.

B. Rolling vs. Static Keys: Rolling codes change on each use, thwarting replay attacks, while static but encrypted credentials stored in secure elements allow offline access.

C. Distance Bounding (UWB): Measures signal time‑of‑flight to confirm proximity, blocking relay attacks that extend BLE or NFC ranges.

D. Biometric Reinforcement: Optional fingerprint or facial‑recognition on smartphones adds a human‑presence check before transmitting credentials.

E. Revocation & Listing: OEM cloud services maintain allowlists and blocklists to immediately revoke lost device access and prevent unauthorized re‑registration.

User Convenience and Personalization

Digital keys unlock new user‑centric features absent in traditional fobs:

A. Passive & Hands‑Free Entry: Doors unlock automatically upon approach and relock on departure—no buttons required.

B. Custom Profiles: Vehicles load driver settings (seat, mirror, climate, infotainment preferences) based on the detected device, streamlining multi‑driver households.

C. Temporary Guest Access: Owners can issue time‑bound or location‑bound digital keys to friends, family, or valet services via secure app links.

D. Multi‑Device Support: Car keys can be provisioned on multiple devices—phones, smartwatches, or wearable tags—without additional fobs.

E. Seamless Engine Start: With the authenticated device inside, push‑button start or automatic power‑on for EV drive modes starts the vehicle instantly.

Integration with Connected Services

Digital keys form part of a broader connected‑car ecosystem:

A. Remote Management Portals: OEM cloud platforms allow owners to view active keys, audit usage logs, and remotely revoke access from anywhere.

B. Fleet and Subscription Services: Fleet managers can provision and rotate key assignments for drivers, optimizing logistics for rentals and corporate pools.

C. Location‑Based Automations: Vehicles can trigger geofenced actions—pre‑conditioning climate, charging initiation, or parking reminders—based on key proximity.

D. Over‑The‑Air Feature Unlocks: Subscription‑based access to parking, charging networks, and premium driver‑assist functions activated via digital key status.

E. Vehicle‑to‑Smart‑Home Sync: Authorized keys enable home automation triggers (garage door open, smart lights on) as drivers approach, integrating the entire mobility journey.

Industry Standards and Alliances

To ensure interoperability and security, global standards bodies and consortiums play critical roles:

A. Car Connectivity Consortium (CCC): Defines the Digital Key Specification, standardizing NFC and BLE usage across OEMs for universal digital key compatibility.

B. Bluetooth SIG: Develops BLE security profiles and enhancements—such as LE Secure Connections—to strengthen passive entry against eavesdropping.

C. FiRa Consortium: Advances UWB standards for secure fine‑ranging, publishing certification programs that validate compliant devices and vehicles.

D. SAE J2945: Provides guidelines for communication security in V2X and in‑car wireless systems, complementing digital key safety requirements.

E. ISO/SAE 21434: Specifies cybersecurity risk management processes for road vehicles, mandating security considerations throughout the digital key lifecycle.

Smartphone Platforms and Ecosystem Support

Major mobile OS vendors have built-in frameworks to simplify implementation:

A. Apple CarKey: Available since iOS 13.6, leverages NFC and TEE to store digital keys in the Apple Wallet, supporting shareable keys via iMessage.

B. Android Digital Car Key: Introduced in Android 12, integrates with Google Wallet, using TEE and hardware‑backed Keystore to secure BLE and NFC credentials.

C. Wearable Compatibility: Smartwatch support for passive entry (e.g., Apple Watch, Wear OS) enables quick access without reaching for the phone.

D. Third‑Party SDKs: Platforms like OpenCar and FiRa provide developer kits to OEMs and Tier 1 suppliers, accelerating digital key feature rollouts.

E. Cross‑Platform Considerations: Ensuring seamless behavior across iOS, Android, and proprietary head‑unit apps requires rigorous interoperability testing.

Comparison: NFC vs. BLE vs. UWB

Choosing the right protocol mix depends on use case priorities:

A. NFC (Near‑Field Communication):

-

Range: Under 10 cm—ideal for deliberate, tap‑to‑open operations.

-

Security: Low relay risk due to proximity, but lacks distance measurement.

-

Use Cases: Secondary access modes, smartphone wallet integration, guest provisioning.

B. BLE (Bluetooth Low Energy): -

Range: Up to 10 meters for passive entry—hands‑free convenience.

-

Power: Low battery impact, continuous scanning feasible.

-

Security: Vulnerable to relay attacks unless supplemented with distance bounding.

C. UWB (Ultra‑Wideband): -

Accuracy: Centimeter‑level ranging prevents unauthorized extended‑range exploits.

-

Complexity: Requires UWB radios in both vehicle and device—higher cost and ecosystem maturity required.

-

Best For: High‑security premium segments demanding robust relay attack mitigation.

Overcoming Technical and Adoption Challenges

Implementing digital keys at scale demands addressing several hurdles:

A. Device Fragmentation: Ensuring compatibility across myriad device models, OS versions, and wearables requires extensive validation matrices.

B. Interference and Signal Blockage: Metal key fobs, phone cases, and environmental RF noise can impede BLE/NFC signals—necessitating robust antenna design.

C. User Experience Complexity: Balancing security prompts with frictionless entry requires carefully designed UI flows and fallback mechanisms for lost devices.

D. Regulatory Compliance: Privacy laws (GDPR, CCPA) and local wireless regulations may restrict data collection and transmission during digital key operations.

E. Lifecycle Management: Handling device transfers—reselling phones, transferring ownership of cars—demands secure key revocation and re‑provisioning processes.

Leading OEM Implementations

Several automakers have already brought advanced digital keys to market:

A. BMW Digital Key Plus: Combines UWB and BLE for passive entry, with Apple Wallet integration and multi‑user profiles.

B. Audi myAudi Key: Supports NFC card keys and smartphone access, integrated with the myAudi app for remote management.

C. Hyundai Digital Key: Enables sharing up to four digital keys, with BLE and proximity detection for seamless entry.

D. Genesis Digital Key: Uses Android and iOS wallets, offering biometric confirmation and remote ignition disablement for security.

E. Tesla Mobile Key: BLE‑based passive entry and start, extensible to multiple drivers via Tesla app permissions.

Security Incident

Even leading digital key systems have faced real‑world tests:

A. Relay Attack Demonstrations: Security researchers showed how unsophisticated BLE relay kits could unlock and start some early implementations—prompting firmware updates.

B. NFC Emulator Exploits: Phone‑based NFC emulators were used to clone static digital key tokens on certain head units—underscoring the need for rolling codes.

C. App‑Side Vulnerabilities: Flaws in companion apps permitted unauthorized key provisioning via improper authentication flows—leading OEMs to tighten mobile API security.

D. Mitigations: Patches often included encrypted BLE advertising payloads, UWB ranging enforcement, and hardened back‑end token validation.

Future Directions and Innovations

Digital car keys will continue to advance through several emerging trends:

A. Multi‑Factor Access: Combining digital keys with biometric identity checks (face, voice, fingerprint) for multi‑factor authentication.

B. Blockchain‑Backed Key Management: Leveraging decentralized ledgers to record key transactions and ensure tamper‑evident provision logs.

C. Contextual Access Controls: AI‑driven policies that adapt key permissions based on driver behavior, location, and risk profiles.

D. Vehicle‑to‑Device Handoff: Seamless transition of digital key control between devices—phone, watch, in‑car infotainment—without re‑authentication.

E. Integration with Smart Cities: Citywide mobility platforms where digital keys unlock shared micromobility, parking, and public transit access in a unified ecosystem.

Conclusion

The shift to digital car keys marks a pivotal step in the journey toward software‑defined vehicles and connected mobility services. By supplanting metal and plastic fobs with secure, flexible, and user‑centric digital credentials, automakers are elevating convenience, security, and personalization to unprecedented levels. While challenges around interoperability, security hardening, and user education remain, ongoing advancements in BLE, NFC, UWB, and secure enclave technologies promise ever‑more robust and seamless experiences. As global standards mature and smartphone ecosystems fully embrace digital key frameworks, vehicle access will become as simple as a tap—or even an automatic handshake—between trusted devices, reshaping our relationship with the car for the digital age.